These conditions restrict how quickly additional NAND supply can reach the market, even as pricing incentives increase.

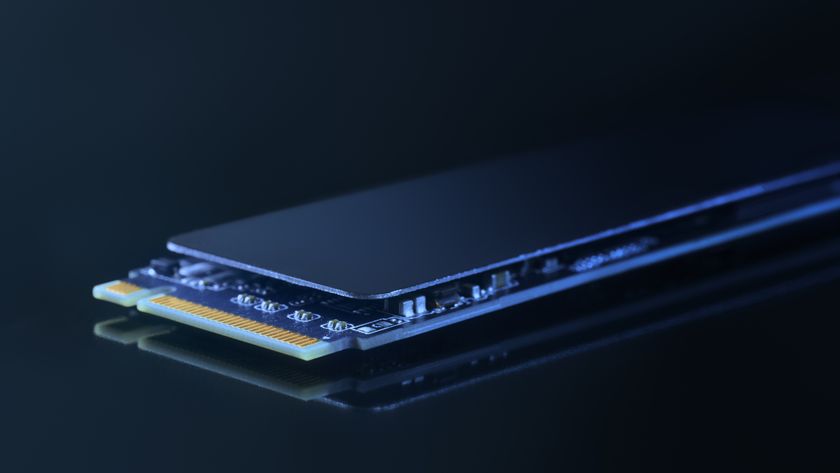

techradar.comNAND Flash pricing is entering a phase of sustained pressure that mirrors, and may exceed, recent DRAM market disruptions.

New data from TrendForce suggests SSD component costs are no longer driven by short-term inventory cycles.

Instead, structural shifts in production strategy and demand composition are reshaping how NAND Flash is supplied and priced.

Supply strategies restrict bit growth

The recent forecast challenges assumptions that NAND pricing will normalize once temporary market imbalances fade, particularly as enterprise storage demand continues to expand.

Memory suppliers have adjusted NAND Flash strategies toward efficiency improvements rather than aggressive capacity expansion.

Manufacturing focus has shifted ...

Copyright of this story solely belongs to techradar.com . To see the full text click HERE